On 26 and 27 June, 2017 international experts gathered in Bizkaia to discuss responsible investment (ESG) at the I Biscay ESG Global Summit.

Why Bizkaia?

Bizkaia has traditionally been a financial centre, home to major banks, with leading financial professionals furthering their careers in the province. It is the land of culture and of ethical, environmental and social values. The union of Bizkaia with ESG investments is a natural and logical union of both cultures: the financial culture and the culture of values.

Some figures

In 2005, the United Nations established the Principles for Responsible Investment (PRI), which have been the main catalyst worldwide for socially responsible investment criteria to be adopted. The PRI have attracted 1700 signatories since they were introduced and they represent a volume of assets of over $60 billion.

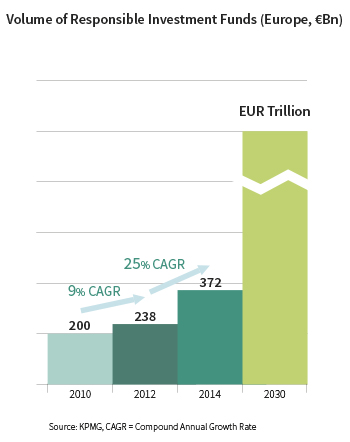

The volume of responsible investment funds in Europe has seen exponential growth which is expected to continue in the coming years (figures in €bn).

Europe leads the way in terms of assets under management out of the total assets:

Europe continues to lead the world of sustainable investments, but the USA is the second market and is the one showing greatest growth (sustainable investment in the USA now accounts for $1 of every $6 in professional asset management).

In Spain, the equity of the funds managed according to environmental, social and good governance criteria was over EU 169,000 million in 2015, five times higher than just 6 years earlier

In 2015, the volume of assets managed in Spain was up 16.3% on 2013. In that period, the pension fund and collective investment market rose 13.6%.

ORGANIZES:

COLLABORATE: